Taxfiler is aimed primarily at accountancy professionals who are likely to be working with multiple clients across a range of different areas. It’s been built to allow workmanlike scrutiny of bookkeeping entries from the likes of corporations through to limited companies, sole traders or freelancers and can also be used for personal tax returns too.

The Taxfiler package is just one product from IRIS Software, which has numerous other well known solutions used by finance professionals in the UK. It will therefore be useful to any firms who already work with products in the portfolio who will see the benefit of a cross-program workflow. Taxfiler also connects to QuickBooks Online, Xero and Kashflow for the quick and easy change of accounting data.

Although it’s aimed at professionals, a version of Taxfiler is available for taxpayers who cannot use the free software provided by HMRC, including non-residents who have to submit form SA109, partnerships or Trusts & Estates.

- Want to try Taxfiler? Check out the website here

Pricing

It doesn't appear to be possible to try out Taxfiler for a trial period, although the website does have a fully working demo of what to expect. The site does also say you can get three months free if you move to Taxfiler from another service. No matter, as the demo lets you get a solid overview of the features and functions, even though you have to work with the data that is already present within the system.

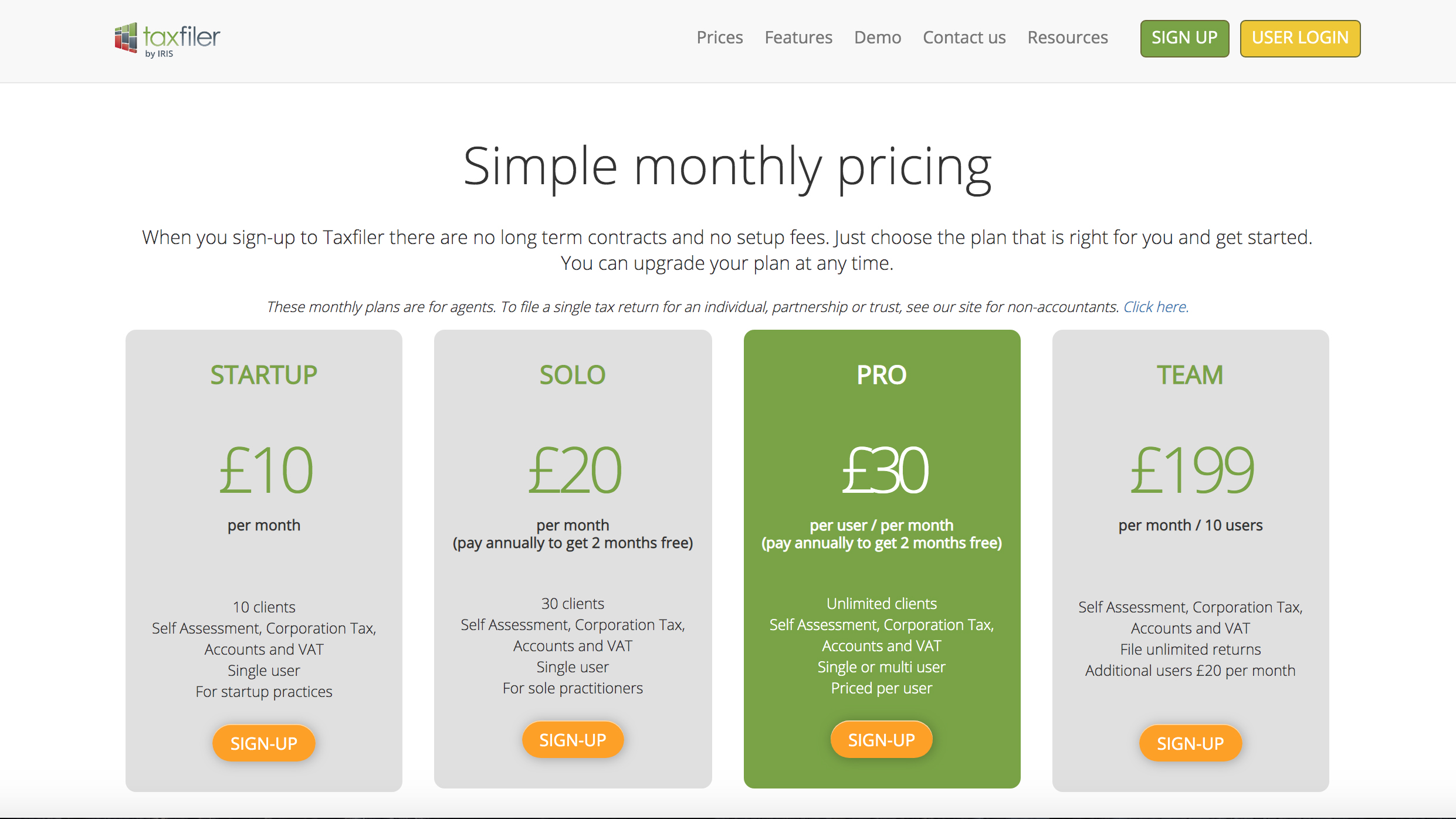

When it comes to package options it’s Startup that gets the ball rolling, which is £10 per month and allows 10 clients and the processing of self-assessment, corporation tax, accounts and VAT for a single user. It's aimed at startup practices.

Next, Solo is £20 per month (pay annually to get 2 months free) and allows 30 clients, covers self-assessment, corporation tax, accounts and VAT. Again, this is for a single user such as a sole practitioner.

The Taxfiler Pro package is £30 per user, per month (pay annually and get 2 months for free). This option allows unlimited clients and will cover self-assessment, corporation tax, accounts and VAT requirements.

Finally, Taxfiler’s Team package is £199 per month/10 users and also covers self-assessment, corporation tax, accounts and VAT needs. Subscribers to this one can file unlimited returns.

Additional users can be added for £20 per month. Non-residents of the UK can turn to a version of Taxfiler if they have to complete form SA109 and the cost for this is £30. A Partnership edition is £36 while a Trust & Estates package is £44. These are all suitable if you're unable to use the standard HMRC software.

Features

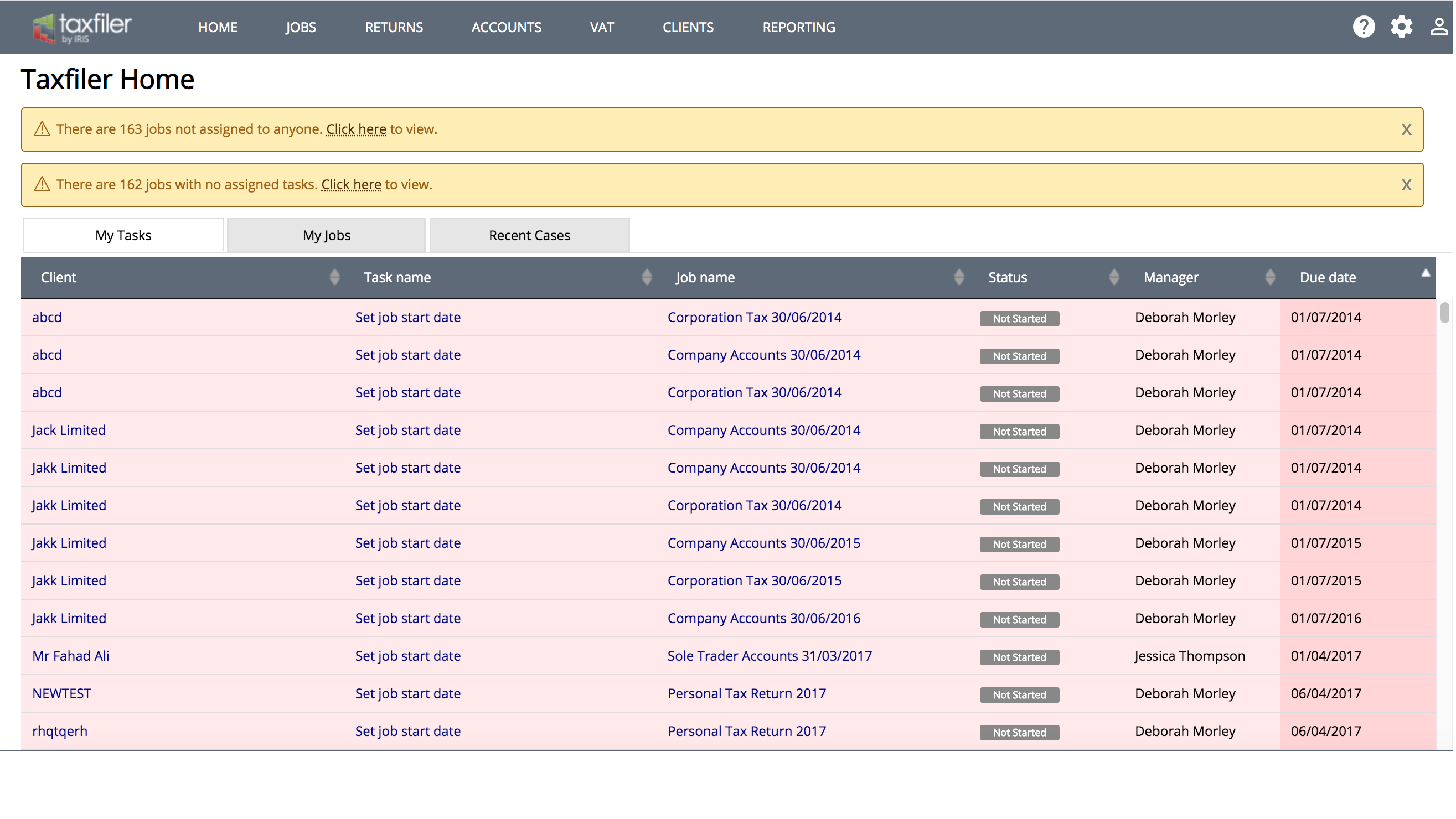

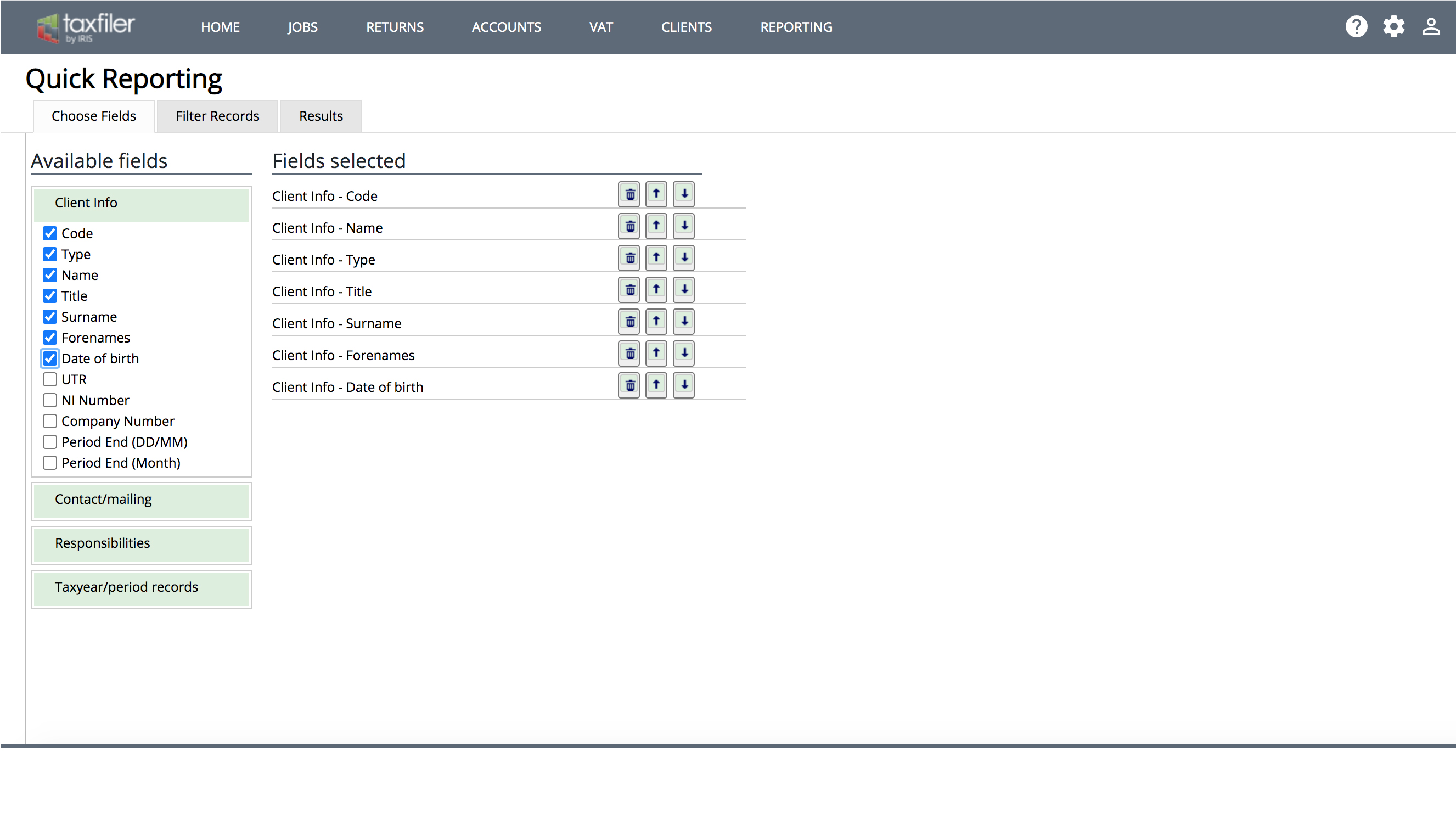

There’s no doubt that Taxfiler comes with a powerful feature set, with lots to offer accountants who might be tasked with sorting out all sorts of different kinds of financial affairs. While the interface isn’t really too inspiring in terms of aesthetics, it’s got all of the tools needed to get the job done.

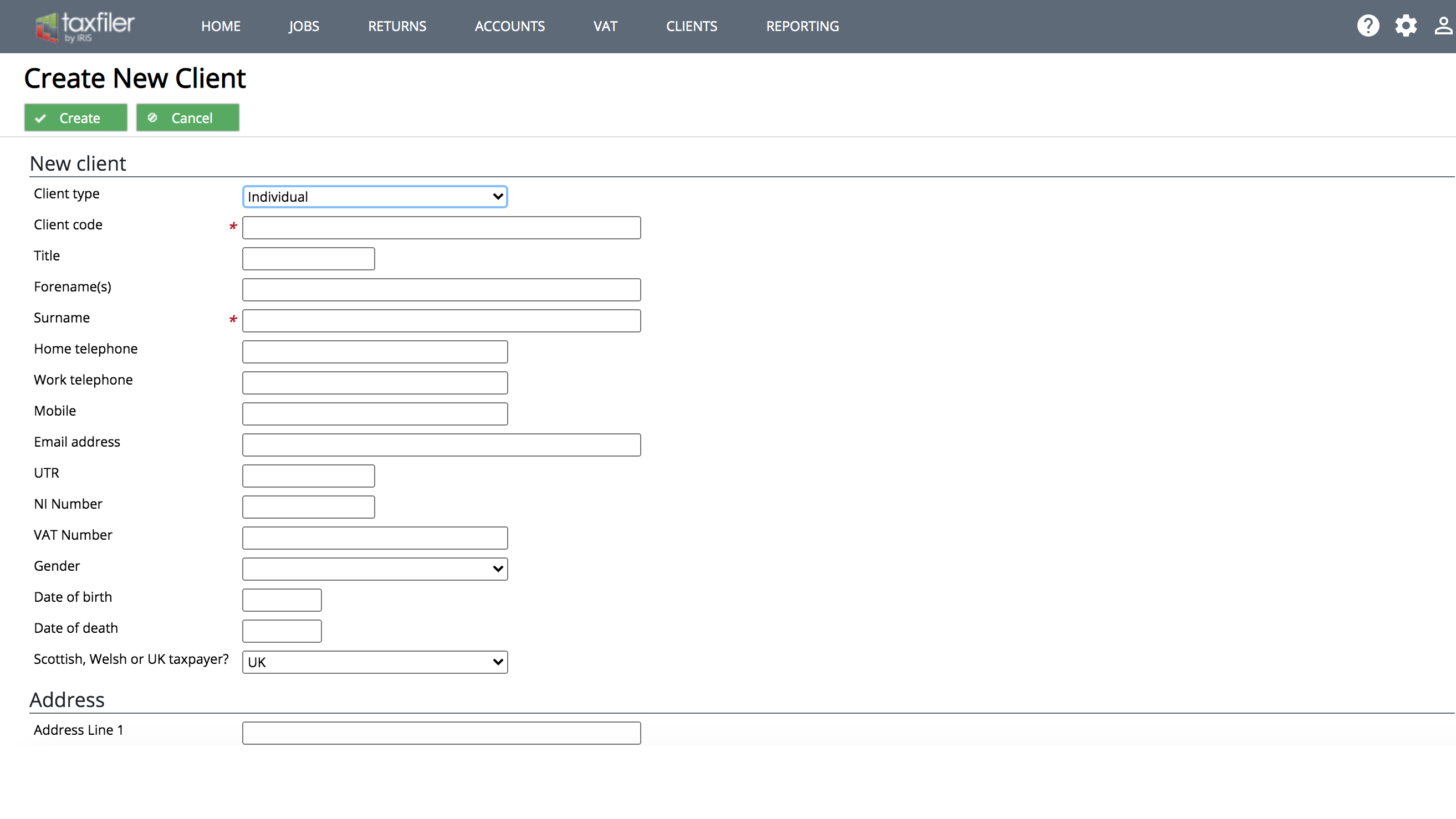

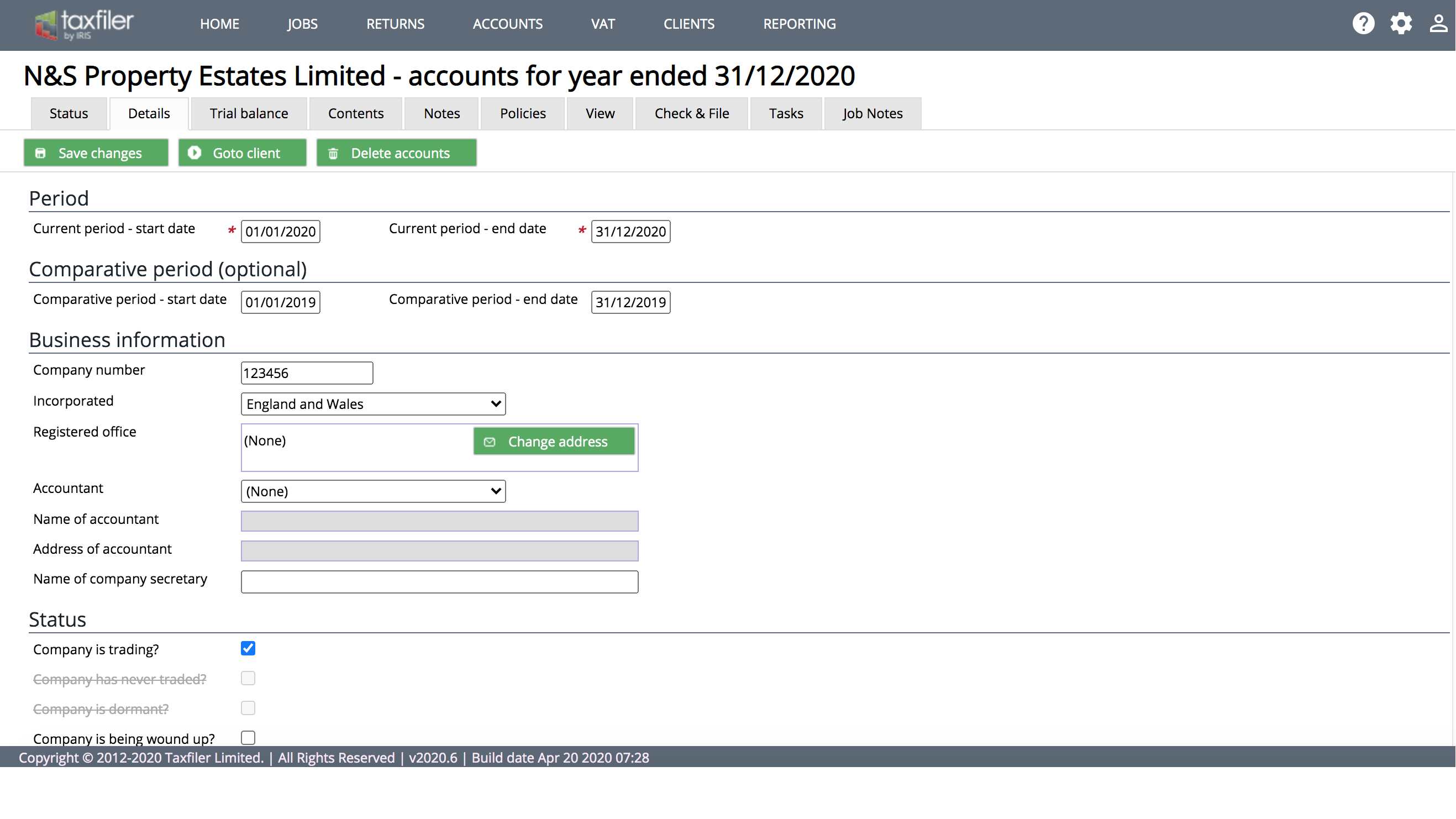

Accountants can populate the software using either manual means, or automate the process using data from bookkeeping software. It’s also possible to submit accounts directly to Companies House in a one-click operation. Taxfiler has been configured so that it is MTD compliant and can be used for small companies, micro-businesses, sole traders and partnerships, with tools within the interface that allow you to set up your preferred route with ease.

In addition, Taxfiler comes with everything needed to tackle corporation tax as well as personal tax affairs. Partnership tax and trusts and estates affairs can be handled too, all of which can be done using the automatic import option if you're transferring key information from existing software.

Performance

Taxfiler is aimed at covering everything from the preparation and filing of accounts, tax and Making Tax Digital VAT returns so it’s expected to do quite a lot. Being a cloud-based solution though means that there’s no software to download and you can access all of the features and functions within the service via a web browser. Based on the data we got to try within the dashboard and other areas, Taxfiler seems to work very nicely indeed.

Ease of use

You’ll need to spend some time acquainting yourself with Taxfiler as it’s powerful and can have a complex feel if you’re not familiar with detailed accounting practices. However, seeing as it is aimed at accountancy professionals in the main, the workspace features lots that will be familiar to that sector.

Support

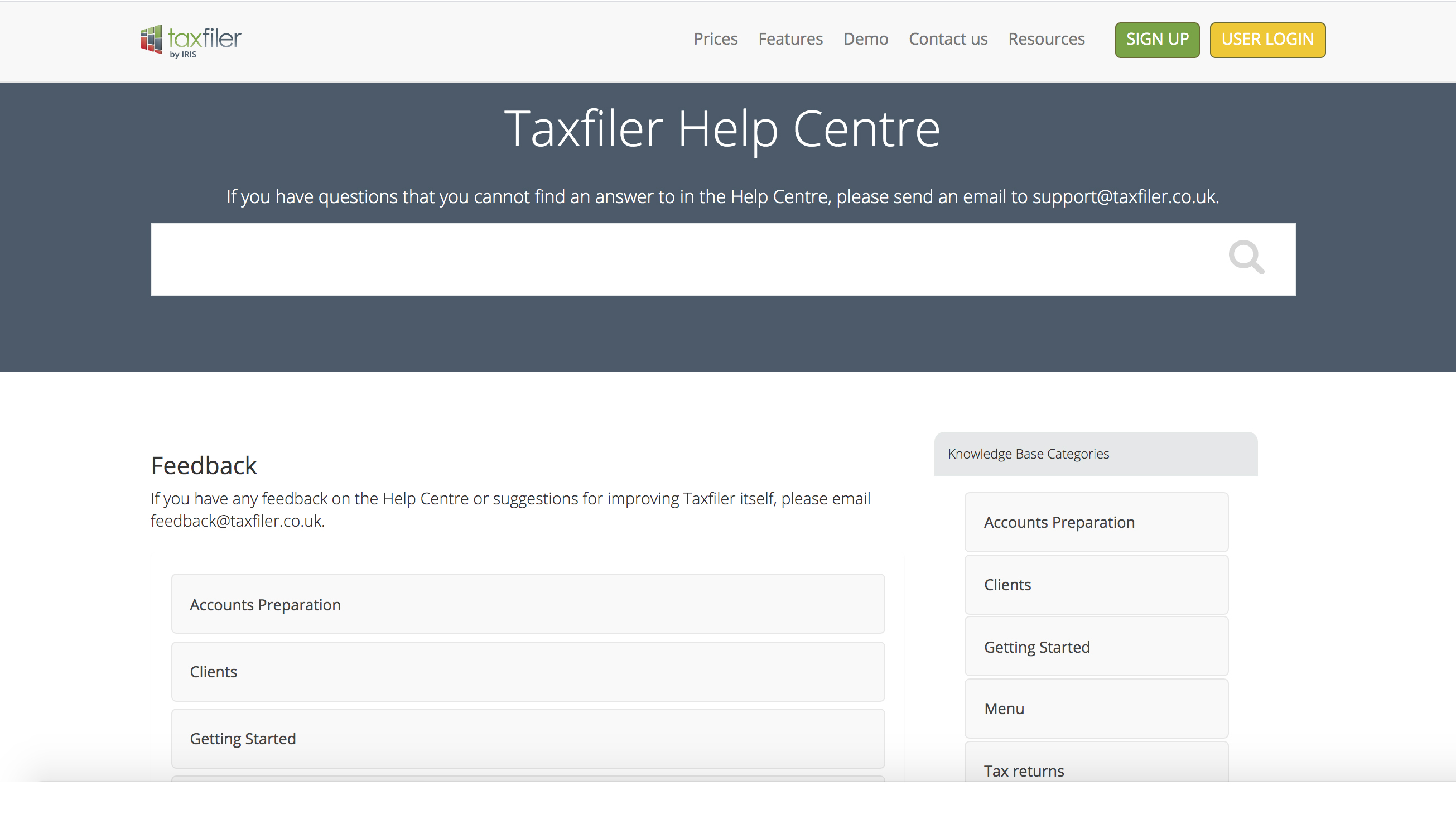

You’ll find that there’s a built-in help panel within the Taxfiler interface, but it is also possible to head to a dedicated website help centre too. Inside this area you’ll find a comprehensive knowledge base, along with instructional videos and other support aids that have been designed to help you get the best from Taxfiler.

There doesn’t appear to be any support available by phone, however, with a support email being the main way to contact them according to the Taxfiler website. However, there are some other support-style highlights, with a Blog and FAQ section making up part of the Resources section of the site.

Final verdict

Taxfiler ticks a lot of boxes if you’re looking to tackle numerous client accounts and want to use a cloud-based service that has the already solid foundations of IRIS Software. In fact, you might even already be using a package from this supplier, which makes Taxfiler an even more logical move.

The online service is certainly well put together and contains lots of tools for taking on all kinds of accountancy and tax chores. While the interface isn't the most inspiring to use, it does pack a punch and definitely covers all bases if you’re hopefully eager to your clients happy.

- We've also highlighted the best tax software

from TechRadar: Technology reviews https://ift.tt/2O5ElWJ

No comments:

Post a Comment