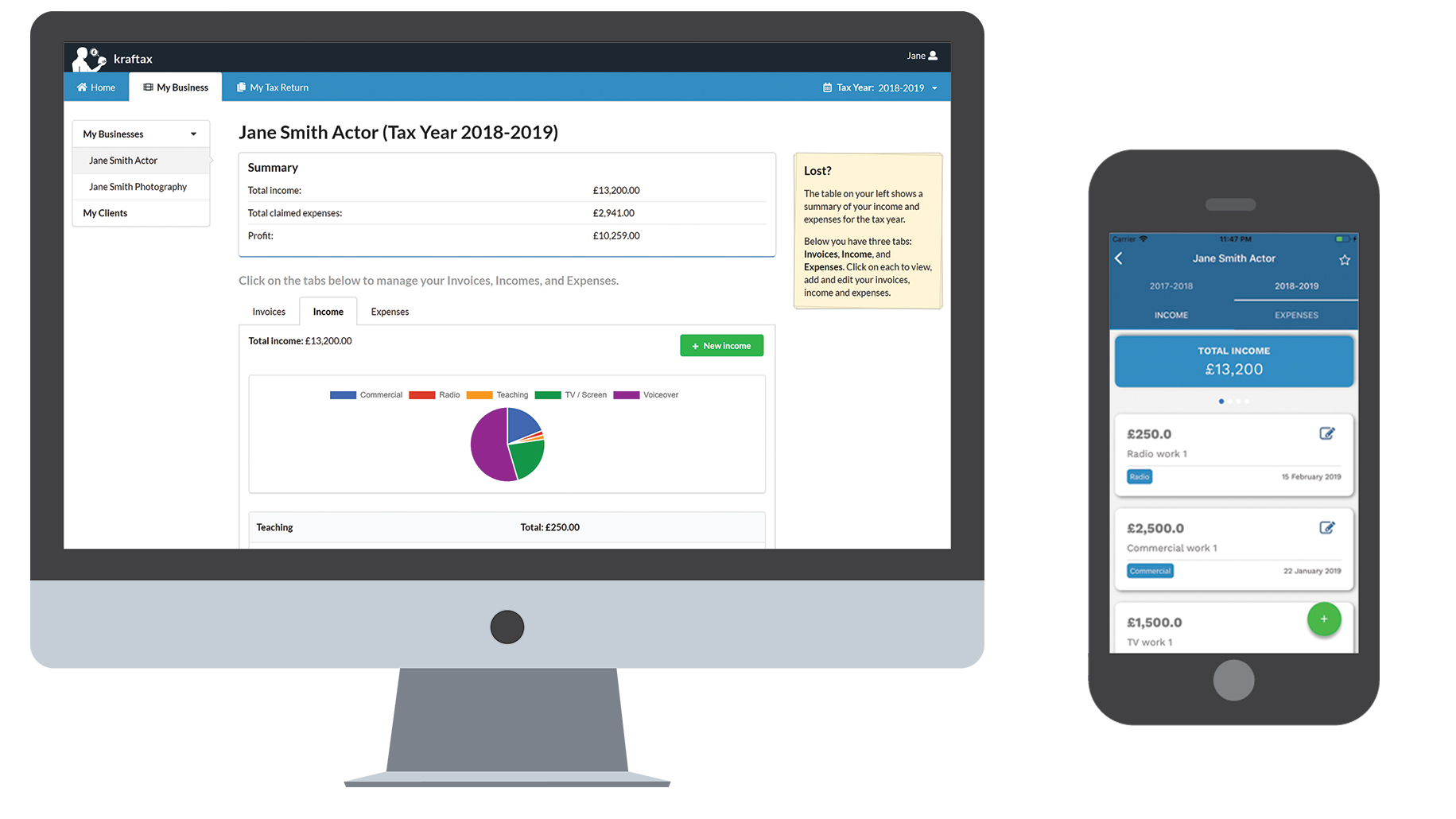

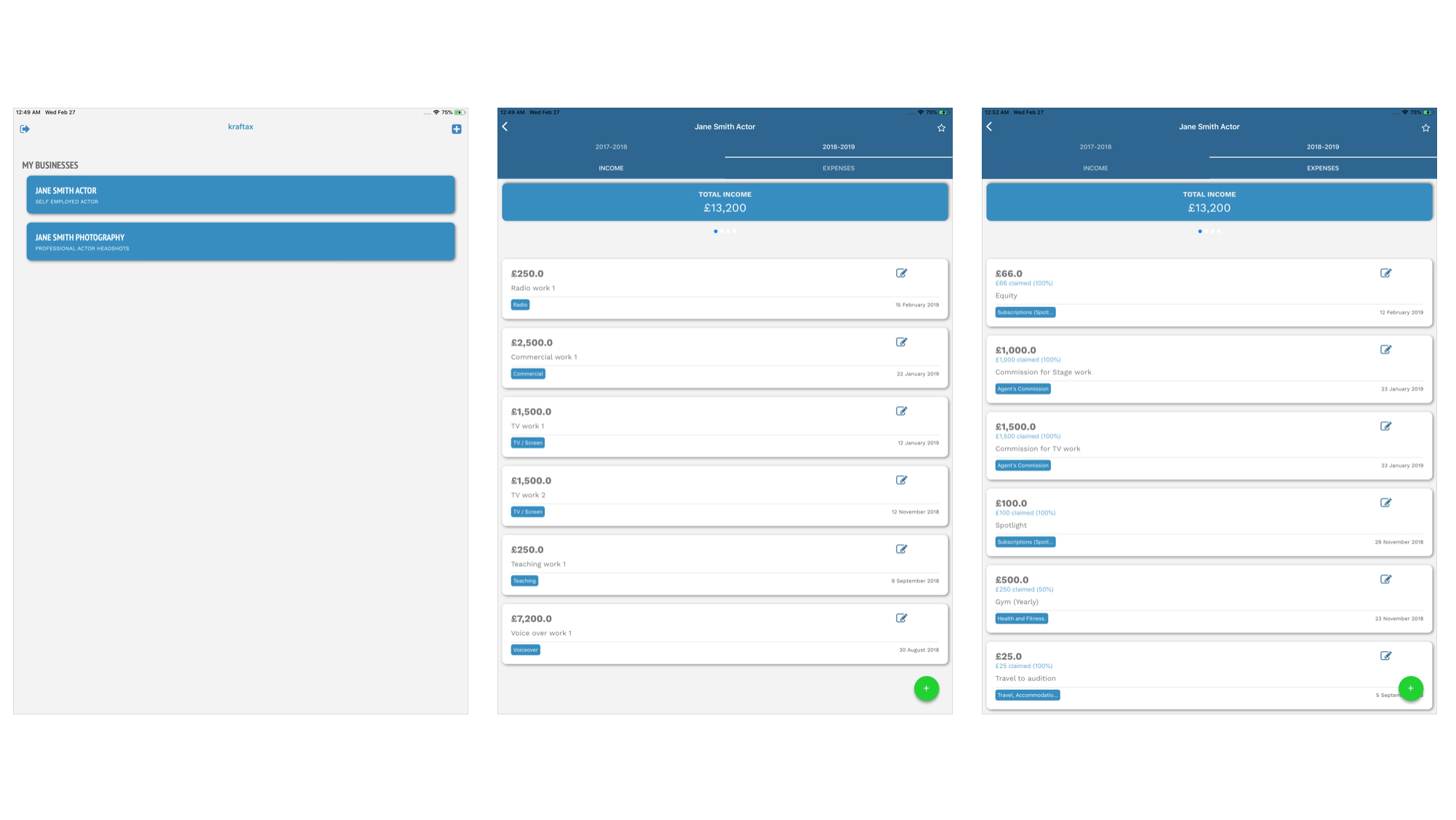

Kraftax is an accounting application, which is recognized by HMRC in the UK and can be used to help self-employed artists keep on top of their finances. Alongside the management of money, Kraftax allows users to send invoices as well as letting them submit annual tax returns when the time comes.

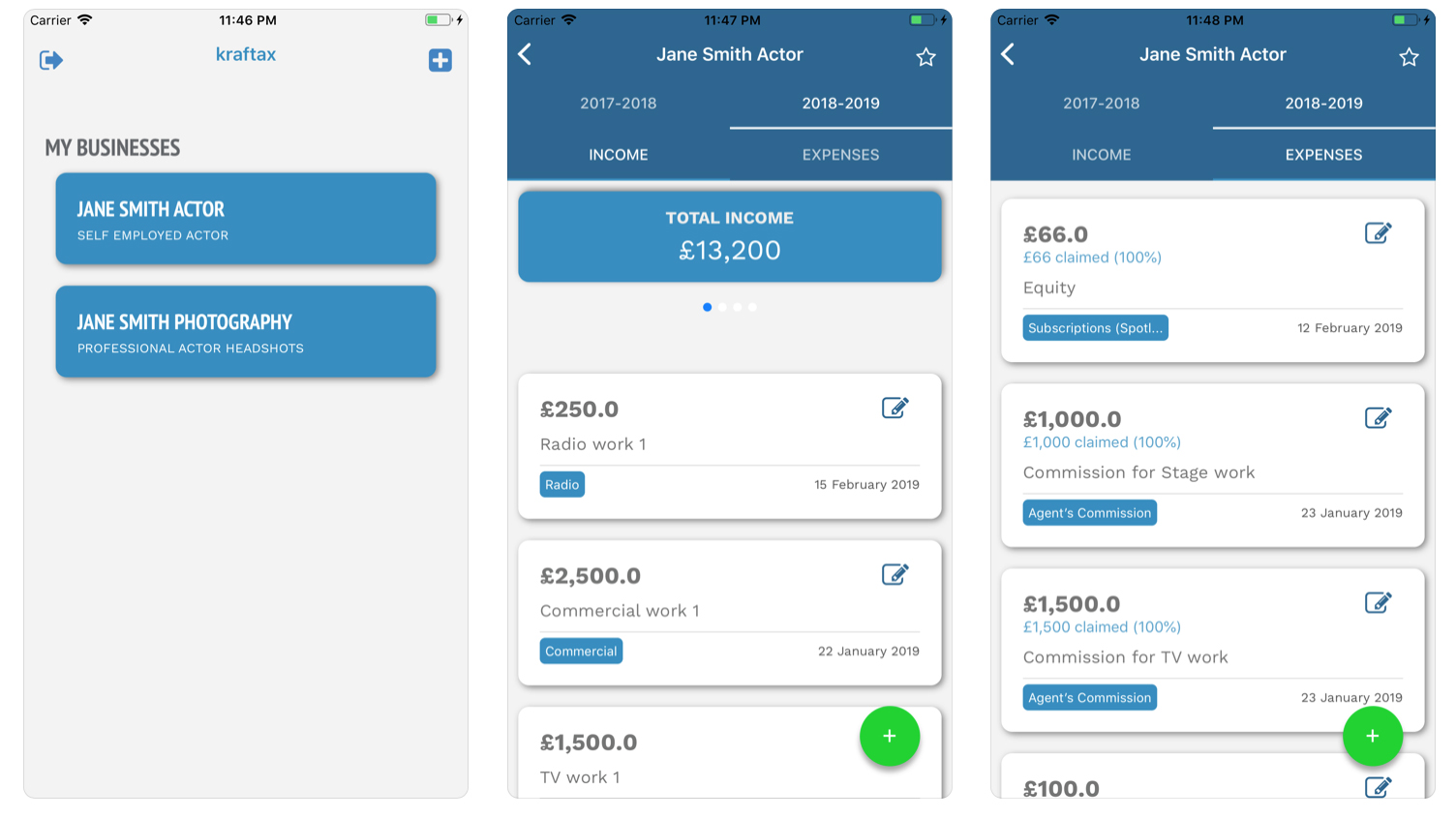

Income and expenses can be easily tracked while the Kraftax app works in tandem with the website allowing easy synchronisation if you’re working away from home or the office on a one-off or regular basis. The software was created as a result of two actor/musician cousins, so it’s been designed with first-hand experience of the specific marketplace.

- Want to try Kraftax? Check out the website here

Pricing

Surprisingly, given its usefulness, you can experience the Kraftax website and associated app for free, which its creators say they hope to maintain for the foreseeable future.

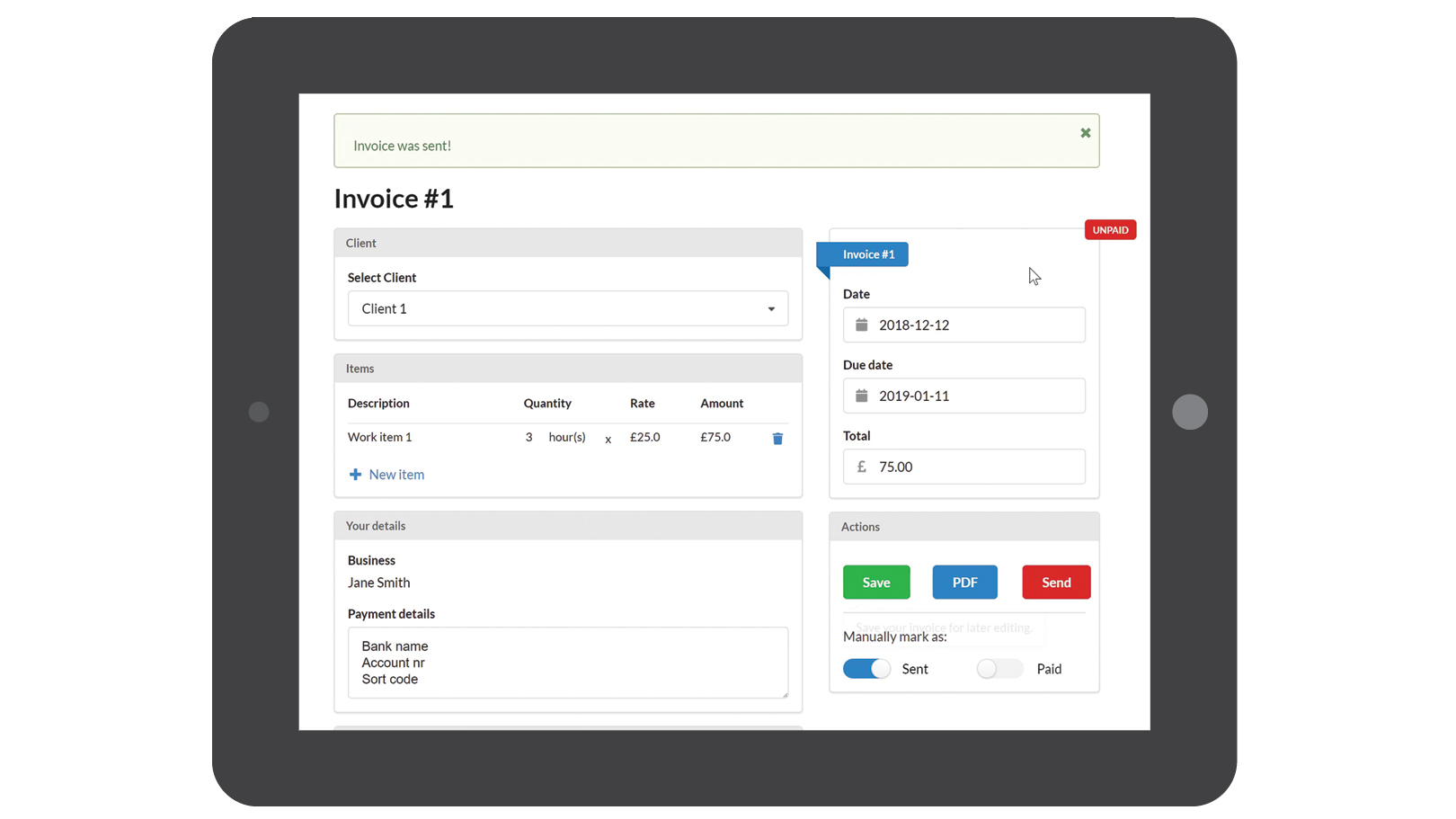

You should note, however, that being able to use the invoicing feature does involve a cost, albeit a pretty minimal one. With its no frills stance Kraftax therefore works on an annual subscription model and this unlocks the potential of the invoice feature. This currently costs £30 and provides good value considering the streamlined way it lets you to carry out multiple business chores in one place.

Features

Perhaps the best thing about Kraftax is the way that it's been designed with simplicity in mind. Many self-employed and freelance professionals are often pushed for time, so the ability to manage finances, send out invoices and also submit a tax return from one software service makes real sense.

Three core ingredients lie behind the overall appeal of Kraftax: finance management, invoicing and the submitting of tax returns. Remember that the £30 annual subscription route delivers a much more complete experience though, including managing your clients and, crucially, being able to send them invoices.

Performance

We found Kraftax to be decidedly zippy to use, both in its web-based desktop edition as well as via the app. With a reasonably minimalist interface there’s not too much to inhibit the day-to-day running of Kraftax either, although that may change as you build up successive years of tax affairs.

As it stands though, Kraftax is lean and more than able to cope with everyday financial management tasks. Again, the secret of its success seems to be by keeping things as simple as possible.

Ease of use

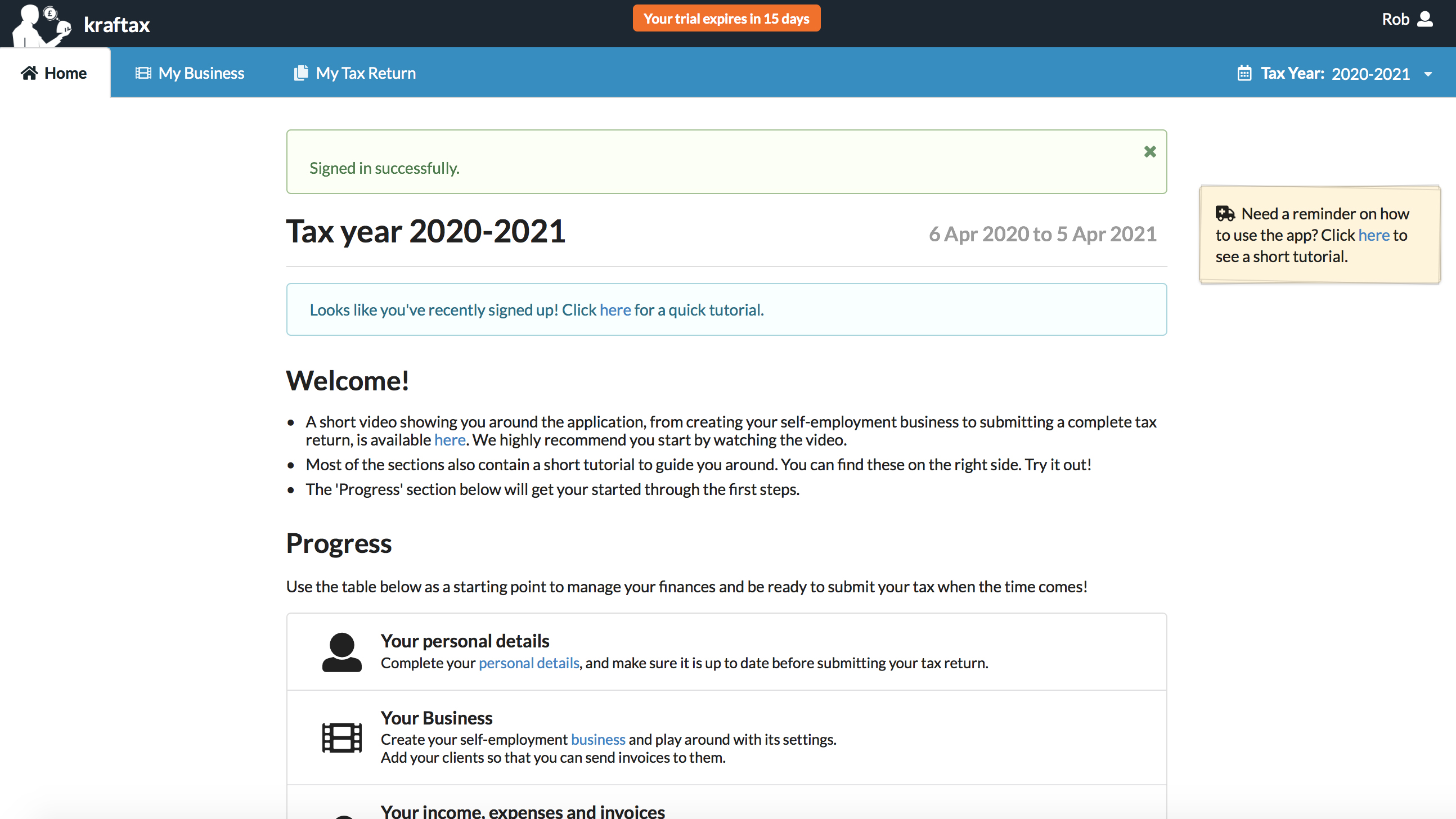

Signing up for Kraftax is really easy and requires nothing more than an email address and password to get started. You actually get a completely free trial for 15 days, which lets you explore all of the features found within the subscription edition of the service.

There’s a useful video once you log in for the first time, which takes you on a guided tour of the main features and functions. This is worth spending a few moments to do as it shows you how to get the best from the experience. However, there are also other tutorials to take you through the different sections of the site and service, along with one dedicated to using the app.

Meanwhile, the Progress panel helps you keep track of the stages you’ve completed within Kraftax. Usefully, the personal details section of the site can be completed with important items such as your National Insurance number and your Unqiue Tax Reference (UTR) to streamline tax-filing duties.

Support

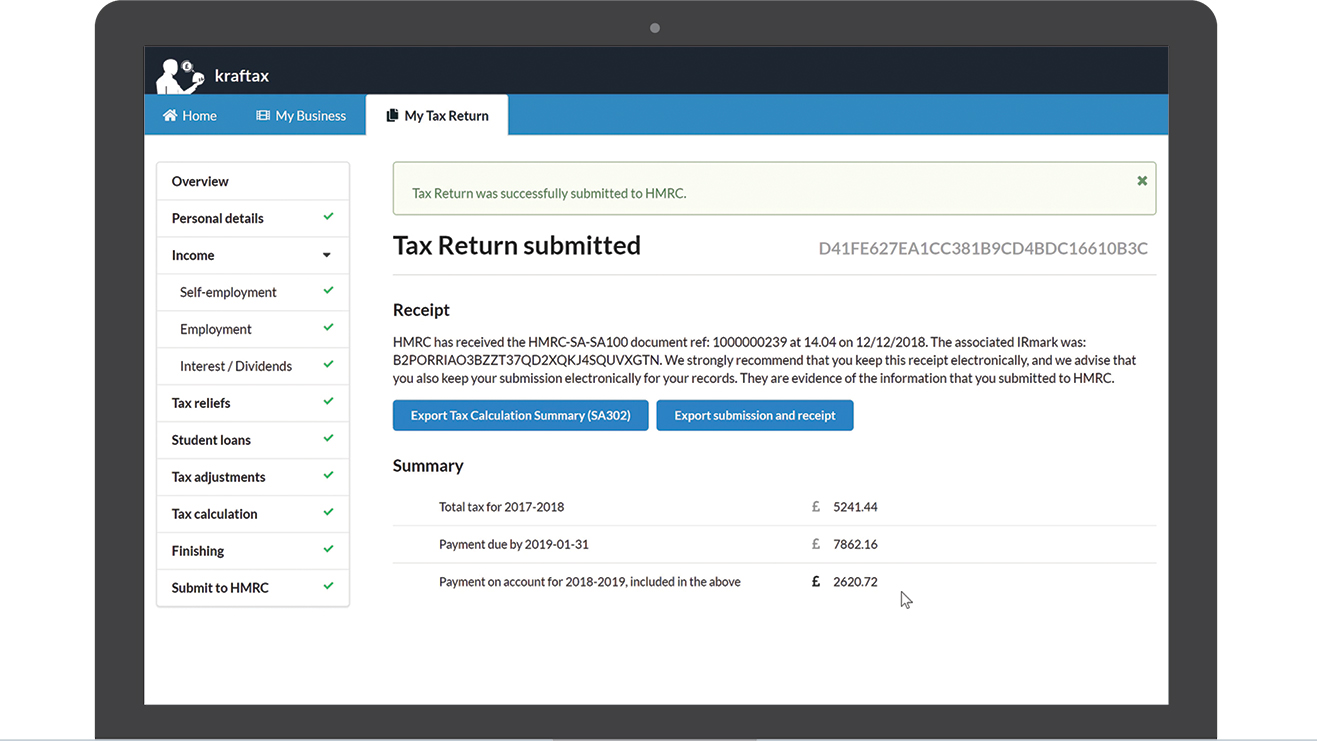

We couldn't find any obvious means of support when we took our tour of Kraftax, but in truth there doesn't seem to be much that could tie you up in knots. In terms of what it can handle then the Kraftax website can support the following schedules: Basic Tax Return (SA100), Employment (SA102), Self-Employment - Short (SA103S), UK Property (SA105), Residence, remittance basis, etc. (SA109) and Tax Calculation Summary (SA110).

Kraftax says that other schedules are due to be implemented in future releases. Presumably your tax office can help with anything else outside of the software service itself.

Final verdict

Kraftax isn’t one of those services that tries to cover all bases and that’s its real strength. This is a web-based service that comes with a neat app for tackling the everyday financial affairs of the self-employed and freelancers of the UK. That’s about it, which is a great idea.

It’s been carefully geared up to help you file tax returns to HMRC while also keeping a tight reign on your outgoings and earnings in the meantime. Add on the affordable £30 subscription fee to unlock the power of its invoicing tools and you’ve got a package that will soon be saving you both time and money. And all without the need to get stressed while you’re doing it.

- We've also highlighted the best tax software

from TechRadar: Technology reviews https://ift.tt/2A6QWp8

No comments:

Post a Comment